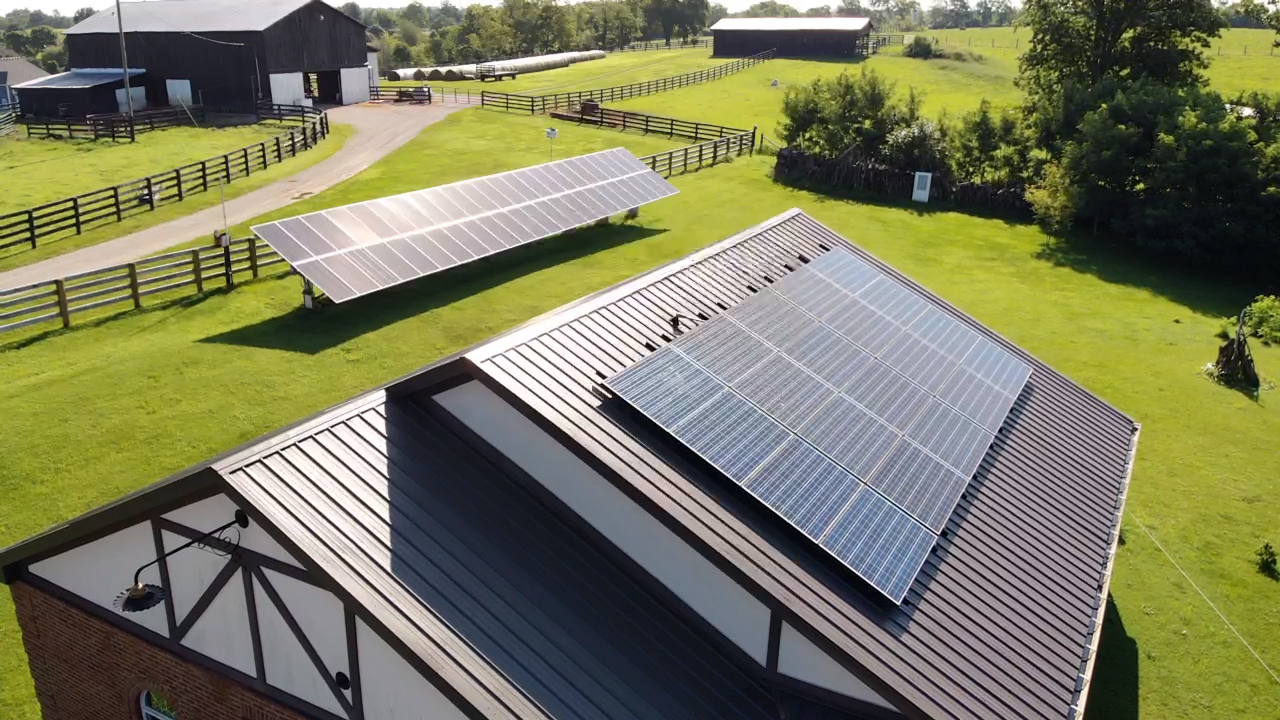

Dive into the sunlit opportunities of the Bluegrass State with our 2024 Guide to Kentucky Solar Tax Credits, Incentives, and Rebates. Amidst Kentucky's lush landscapes and vibrant communities, solar energy is shining brighter than ever as an accessible and cost-effective solution for reducing energy costs and minimizing environmental impact.

This year, Kentucky is empowering homeowners, businesses, and communities with enticing financial incentives to harness the power of the sun. From generous tax credits that significantly lower installation costs to rebates that put money back into your pocket and incentives designed to accelerate the adoption of clean energy, Kentucky is making solar investments more appealing and affordable.

Here’s what you need to know.

Cost of Home Solar Power in Kentucky

Not sure if you can afford solar in Kentucky? The average cost of a 5 kW system is $14,938 after federal tax credits. That comes out to just $2.99 per watt, including installation.

Even better, the federal tax credit can bring the cost down by 30%. So if you're thinking about a bigger system, say a 10 kW system, it will cost roughly double what a 5 kW system costs. But remember, the bigger the system, the bigger the credit you'll receive towards your federal taxes!

Kentucky Incentives & Loans

Kentucky Property-Assessed Clean Energy (PACE) Financing

- Incentive value: On average, $20,247 of savings over the system’s lifetime.

- Frequency: One-time

- Program: kypace.org

The Kentucky PACE program lets you ditch the $25,000+ sticker shock and embrace solar with low interest rates and minimal down payments. PACE covers 100% of the hard and soft costs of an energy project, eliminating the need for up-front capital. Plus, repayments are conveniently added to your property tax bill, making budgeting a breeze.

Repayment terms can be extended to match the useful life of the eligible improvement for between 15 and 25 years.

While the exact savings vary, PACE financing can be the key to unlocking the door to solar power, turning a dream into an energy-saving reality. Kentucky residents can expect to save an average of $20,247 over the lifetime of their solar system, making PACE financing a potentially lucrative option. Just keep in mind that these savings are based on a cash purchase, so financing will likely reduce your overall savings.

C-PACE financing is available for commercial customers in Kentucky.

KY PACE Financing Steps Through Energize Kentucky

- Initial Eligibility Form: The property owner completes a brief form at KYPACE.orghttps://kypace.org/ to help PACE determine if the property and potential energy project is eligible for PACE financing.

- Energy Project Summary Form: The property owner works with a PACE registered contractor to identify eligible energy saving improvements and quantify the energy savings. This form is submitted with the Energy Project Application.

- Energy Project Application: The application allows the property owner to provide essential financial documentation about the property and its operating status. PACE provides information to its network of registered capital providers to obtain PACE financing terms for the owner. NOTE: The property owner must obtain written consent from the existing mortgage holder before a PACE special assessment can be added to the property’s tax bill.

- Funding: The property owner agrees to financing terms and then the PACE special assessment is added to the property’s tax bill. After the PACE financial closing occurs, the funding will be available for the eligible energy saving improvements. Installation The registered contractor completes the installation of the authorized energy saving improvements. PACE ensures all improvements are installed to the satisfaction of the property owner.

USDA REAP Grants & Guaranteed Loans

- Incentive value: $1,500 to a half-million dollars

- Frequency: Ongoing

- Program: rd.usda.gov

The USDA's Rural Energy for America Program (REAP) can help you grow greener. REAP offers both grants and guaranteed loans for Kentucky’s agricultural producers to assist with renewable energy projects and energy efficiency upgrades. Grants can cover up to a quarter of your project's cost, ranging from $1,500 to a half-million dollars, depending on the project's size and type.

Kentucky Incentives for Energy Independence

- Incentive value: Savings vary

- Frequency: Ongoing

Kentucky's Incentives for Energy Independence offer significant benefits for businesses to go solar. The Kentucky Economic Development Finance Authority (KEDFA) was established to encourage economic development, business expansion, and job creation. Through the program, several solar-related incentives can be taken advantage of to expand industry, small businesses, workforce training, and more.

- Slash upfront costs: Get up to 100% exemption on sales tax for solar equipment.

- Reduce reliance on fossil fuels: Receive severance tax breaks for switching away from fossil fuel providers (up to 80%).

- Earn tax credits: Get back a portion of your solar system's cost through tax credits, potentially covering everything for corporations.

- Get employee wage incentives: There are additional benefits for each worker involved in the solar project.

Local Solar Incentives in Kentucky

Kentucky wants to help you upgrade your home for energy efficiency, even without solar panel rebates. Check out these local programs that make saving money on your energy bill (and the planet!) more affordable. We've got a list of incentives to get you started.

Solarize Louisville

- Incentive value: Savings vary

- Frequency: Ongoing

The Louisville Metro Government, along with the Kentucky Solar Energy Society (KYSES) and the Louisville Sustainability Council, has initiated the Solarize Louisville initiative. This campaign aims to enable households in Louisville/Jefferson County and seven neighboring counties to collectively adopt solar energy, thereby advancing the city’s commitment to achieving 100% clean energy.

Through Solarize Louisville, participating households gain the advantage of group purchasing, accessing discounted wholesale rates for solar installation facilitated by reputable installers like Icon Solar Power and Pure Power Solar.

With discounts ranging from 12% to 18%, the Solarize Louisville program ensures that participants receive optimal value for their investment in solar energy.

Other Local Solar Incentives in Kentucky

- Blue Grass Energy: Get up to $750 back for installing heat pumps, air sealing, or insulation.

- Cumberland Valley Electric: Rebates from $50 to over $1,300 are available for upgrades like heat pumps and appliances.

- Duke Energy: Rebates of up to $450 can be earned for solar water heaters, efficient HVAC systems, and more.

- Jackson Energy Cooperative: Rebates are offered for weatherization improvements to your home.

- Louisville Gas & Electric (LG&E) and Kentucky Utilities (KU): Up to $750 in cash back is available for new heating/cooling equipment and appliances.

- Taylor County RECC: Rebates help offset the costs of heat pumps, energy-efficient windows/doors, and insulation in new construction.

Kentucky Net Metering

What is Net Metering

Net metering is a system in which utilities and their customers, who generate their own electricity (for instance, through solar panels), enter into an agreement. This setup includes residential, commercial, or industrial energy producers.

When these consumers generate more electricity than they consume, they can sell the surplus back to the utility company, receiving credits on future bills. Essentially, the utility company credits the consumer for every kilowatt-hour (kWh) of solar energy that a home does not use and instead feeds back into the grid, leading to lower electricity bills.

Kentucky’s Net Metering Programs

In April 2008, Kentucky updated its net metering law, mandating utilities provide net metering services to customers generating electricity through solar photovoltaic (PV) systems. Following this, net metering became accessible to all customer segments of investor-owned utilities and rural electric co-operatives, with the exception of those under TVA utilities.

Eligibility

Kentucky mandates the installation of a single, dual-direction meter for net metering purposes. Customers are responsible for the costs of any additional meters, meters, or distribution enhancements needed to track electricity flow bidirectionally.

Energy Credits

When a customer's electricity contribution back to the utility exceeds what they consume within a billing cycle, they receive a credit for the surplus generation at the utility's retail rate on their next bill, which rolls over indefinitely. These credits cannot be transferred, and customers maintain ownership of all Renewable Energy Credits.

Overproduction and Restrictions

Should the total capacity of net-metered systems reach 1.0% of a utility's highest single-hour load from the previous year, the PSC may restrict the utility's requirement to offer net metering. In scenarios where time-of-day or time-of-use metering is implemented, customers' electricity returned to the grid is net-metered and credited based on the specific time it is supplied back, in line with the existing time-of-day or time-of-use billing arrangement.

Some Kentucky utility companies with net meter programs:

Louisville Gas and Electric Company

Federal Solar Rebates

Federal Solar Tax Credit

The Investment Tax Credit (ITC), also known as the federal solar tax credit, is a nationwide incentive enabling individuals to receive a tax credit for expenses incurred from the installation of solar panels. This credit provides owners of solar systems a deduction of 30% off the total cost of their system. For instance, purchasing a 10 kilowatt (kW) system at $33,000 means you are eligible for a tax credit of $9,900.

How US Solar Supplier Can Help You Save on Your Next Project

Let US Solar Supplier guide your solar energy project! Consult with us today to find the perfect system for your needs.

Resource Section

https://www.ecowatch.com/solar/incentives/ky#kentucky-incentives-energy-dependence

https://www.energysage.com/local-data/solar-panel-cost/ky/

https://eec.ky.gov/Energy/News-Publications/Pages/Residential-Rooftop-Solar-Resources.aspx